Institutionalized Corruption Among Economists Enables Financial Fraud

Economists, from left, R. Glenn Hubbard, left, Martin Feldstein, and William Rudin, greet then Republican presidential candidate Donald Trump as he arrives to speak at the Economic Club of New York, Thursday, Sept. 15, 2016, in New York. (AP Photo/ Evan Vucci)

In 2013, a court convicted Fabrice Tourre, a mid-level trader at Goldman Sachs, of fraud in the 2008 crisis relating to a worthless CDO called Abacus. A CDO, as used in the 2008 Crisis, was a collection of mortgages with similar maturity dates. CDO stands for Collateralized (the house is the collateral) Debt Obligation (the mortgage is the obligation to repay the money owed).

Tourre sold these as AAA safe for pensions when he knew that John Paulson, who had selected the mortgages for the CDO, had also bet a billion dollars (a really big short) that they would fail. In emails, Tourre had joked about selling that junk CDO to “widows and orphans” — which he actually did!

The economics department at the University of Chicago planned to have him walk out of the criminal court and into its classroom as a teacher for an honors (what irony here) economics course. His potential students found no problem with all this.

But when The Chicago Maroon, the University of Chicago student newspaper, revealed it, public outrage exploded and the university rescinded their offer. Was it just the University of Chicago economics department or were there other universities with the same low ethical standard?

Widespread Corruption In Academia

We have Charles Ferguson to thank for showing us that this was not an isolated incident, but an example of the standard of ethics in many major university economic departments. Ferguson had this to say about the serious corruption in academia:

“Over the past 30 years, significant portions of American academia have deteriorated into “pay to play” activities. These days, if you see a famous economics professor testify in Congress, or write an article, there is a good chance he or she is being paid by someone with a big stake in what’s being debated. Most of the time, these professors do not disclose these conflicts of interest, and most of the time their universities look the other way.”

A clip from Ferguson’s interview in his documentary Inside Job of Columbia University economics professor, former Governor of The Federal Reserve Bank and best-selling banking textbook author, Frederick Mishkin, has become a YouTube classic.

First, a bit of background. As with all economists trusted by the government with positions of influence, Mishkin’s clear capture by corporate and banking interests blinded him to the coming 2008 meltdown. In May 2006, when hedge fund managers were seeing the cracks in our economy, this brilliant economist wrote a glowing report about the state of Iceland’s economy titled “Financial Stability in Iceland” — its economy was the first domino to fall in the 2008 Crisis.

Mishkin could not remember how much he had been paid for the paper (it was $124,000). When Ferguson asked what investigation work he had done, Mishkin replied he had “talked to people” and “trusted the central bank”. Mishkin admitted that he had not disclosed that the Icelandic Chamber Commerce had paid him to do the report.

It was not an academic study by a Governor of the Federal Reserve Bank as it appeared; it was to be a marketing tool for a business organization. When Ferguson pointed out that Mishkin’s cv describes the report as “Financial Instability in Iceland,” Mishkin shrugged it off as a mere typo.

There is an eeriness about this video. Mishkin answers with an almost childlike innocence. As he stumbles, mumbles and fumbles, it seems he is just realizing that he did something wrong. The clip is an important study of a brilliant person who apparently doesn’t know right from wrong when making money. In later interviews, he offers no justification for what he did but rather blames Ferguson for sandbagging him.

Mishkin’s status within the academic community is untarnished. He remains highly respected by his colleagues and is on the editorial board of very influential economic journals. He is currently an editor at the Journal of Money, Credit and Banking; Macroeconomics and Monetary Economics Abstracts; Journal of International Money and Finance; International Finance, and Finance India.

To show that Mishkin was not an anomaly, Ferguson continued with interviews of Mishkin’s boss at Columbia and the head of the Harvard economics department, both of whom proved arrogant and defensive about protecting their own conflicts of interest (sources of big, big bucks).

The Benefits Of Befriending Bankers

Other journalists had disclosed examples of Wall Street’s questionable efforts to capture the top government economic advisers. One of the prime reports on how the Street rewards those who serve it well focused on Larry Summers.

Larry Summers has held about every important position an economist could dream of. To name a couple, he was Secretary of the Treasury and President of Harvard. Summers was a firm supporter of the hands-completely-off Wall Street policies that facilitated the crisis.

In 2005, you may recall from my first article in this series, when Raguram Rajan warned that the economy was in danger of collapse, Summers called him a Luddite. He was also the hatchet man sent by the President’s Working Group on Financial Markets to stop Brooksley Born from investigating fraud in the derivative markets in 1996.

Economists Make Astrologers Look Good: Why They Failed To Predict The Great Recession

In 2009, we got a look at this favored economist’s personal fortune. Summers became director of the National Economic Council in the Obama administration and had to disclose his wealth. This level of earning is definitely not from academia. Summers’ disclosure form stated his net worth to be $17m-$39m. His earnings in the year prior to joining the government were almost $8m; $5 million from the hedge fund D. E. Shaw, one of the largest hedge funds in the world—for part time work, and $2.7 million in speaking fees from Wall Street companies that received government bailout money. Goldman Sachs paid him $135,000 for one speech.

Evidence of this Wall Street method for controlling economists, including offering rewards like big speaking fees for saying what people want to hear instead of the truth, created a barely discernible ripple of public reaction for a short time and disappeared.

Serving Two Masters

You may be overcome with a sick feeling of powerlessness when watching movies like Inside Job. If movies like that and insightful articles by journalists have no effect on politicians, it might seem as if nothing can be done.

Bankers don’t meet yearly around an oaken table wearing cowls in an abandoned castle on a remote secret island plotting control of the world. They’re smart guys; they don’t have to physically meet. They know that whatever benefits Wall Street benefits all bankers. They definitely act in collaboration but from a mutual understanding alone. On deregulation issues, they are united in a brotherhood of one-for-all and all-for-one.

They have developed this cooperative plan for controlling government from their knowledge of a true power base in government, not politicians—their advisors. Politicians have no more understanding of the financial system than the average educated citizen. Politicians are totally dependent on advisors, mainly the economists at the Federal Bank and in the Treasury Department. Control these economist advisors and you control all government policy over banks.

Once we acknowledge the corruption, we can stop it but it will take new and extreme measures.

Certainly, there’s no sense trying to get the economists’ professional associations to pass universal conflict of interest guidelines disclosing all the money they get from Wall Street. That’s not going to happen beyond a few university departments. Besides, wherever these regulations are enacted, they will be honored more in the breach than in the observance.

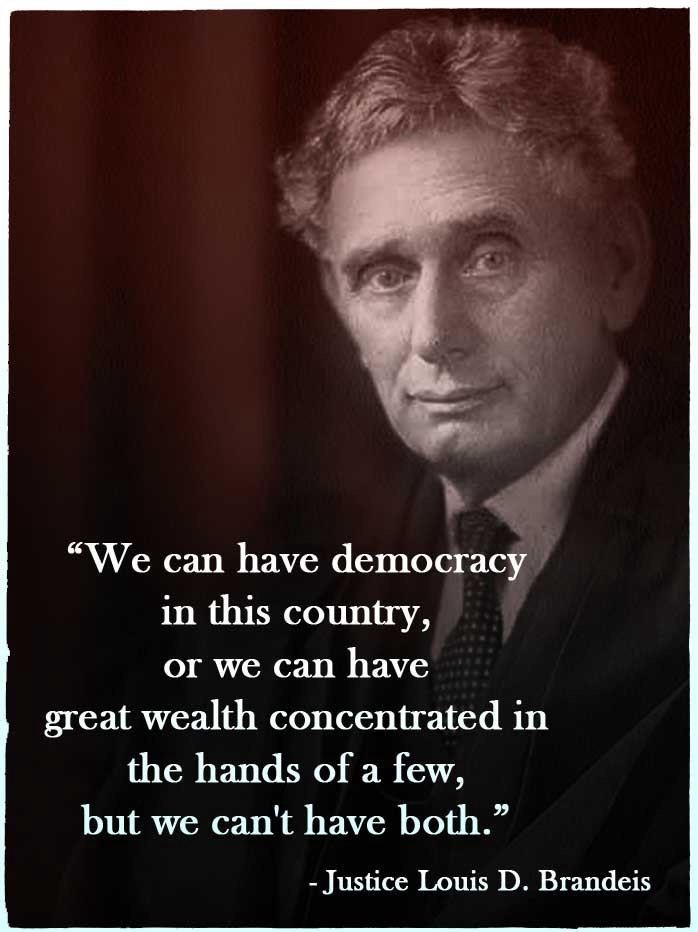

We have to accept that we are living in that situation predicted by former Supreme Court Justice Louis Brandeis.

We now have a concentration of wealth in the hands of a few. We have very little democracy left — but we do have a little. And it’s a power we should use wisely.

We have the ability to shame the politicians when making appointments that affect Wall Street. Politicians on both sides are guilty of appointing economists who are against regulating banks to head our most important organization that regulates banks, the Federal Reserve Bank. This needs to end.

There are many competent economists who are not in the pocket of the banks. The government could prohibit the appointment of any economist for any government position, both regulator or civil service, if they have received payment of any kind, directly or indirectly, from Wall Street five years prior to the appointment. As part of the terms of the appointment, they must also agree not to accept any engagement by Wall Street for five years after they leave government.

Similarly, any economist who has taken payments from Wall Street within five years must register as a lobbyist and be prohibited from testifying before a congressional committee as an independent academic.

It’s a simple but effective solution. The problem? Where are the brave politicians who will champion this cause to break Wall Streets’ seemingly invincible power? And where are the knowledgeable voters who will back them?

We don’t need rockstar economists — they have proven a disaster. We need economists who will put their country before their paycheck.

SIGN THIS PETITION AND DEMAND TRUMP STOP HIS EFFORTS TO REPEAL DODD-FRANK